Fuiyoh, the interest rate is creeping up again, rebounding from the record low level of 1.75% OPR during the pandemic lockdown period. What is that OPR? What is monetary policy?

Lately, many people are arguing that this is not a good time to hike interest rates amid the rising cost of living (high inflation) and our economy is not yet fully recovered. 💢💣

In this article, let us understand the role of OPR in our economy here...

Overview of Monetary Policy in Malaysia

In Malaysia, the responsibility for formulating and implementing monetary policy is entrusted to BNM as the nation’s central bank. The Central Bank of Malaysia Act 2009 states that one of the principle objects of BNM is to promote monetary stability conducive to the sustainable growth of the Malaysian economy.

In promoting monetary stability, BNM is mandated to pursue a monetary policy that serves the interests of the country with the primary objective of maintaining price stability while giving due regard to the developments in the economy.

BNM, through its Monetary Policy Committee (MPC), executes its monetary policy responsibility by adjusting its policy interest rate (Overnight Policy Rate, or OPR). The OPR is the sole indicator used to signal the stance of monetary policy, and is announced through the Monetary Policy Statement (MPS) released after the MPC meeting.

Overnight Policy Rate

- BNM influences the domestic interest rates via the policy interest rate, the Overnight Policy Rate (OPR).

- The MPC of BNM decides on whether the OPR is at an appropriate level to maintain price stability while supporting economic activity.

- The OPR serves as the target rate for the day-to-day liquidity operations of BNM.

- Monetary operations by BNM are undertaken by ensuring an appropriate level of liquidity is in the banking system to influence the average overnight interbank rate (AOIR) to remain around the OPR.

- This in turn sets guidance for other interest rates in the economy, including the interest rates on consumer and business loans and deposits which will then affect the savings and spending decisions of households and businesses.

- By adjusting the OPR, changes in the broad range of interest rates through various monetary transmission channels will, thus, influence the pace of economic activity and inflation.

To prevent excess volatility in the AOIR, BNM has also put in place an interest rate corridor of ±25 basis points around the OPR and standing facilities. BNM provides a lending facility and a deposit facility for the interbank institutions at the ceiling and floor rates of the corridor, respectively. 😃😃😃

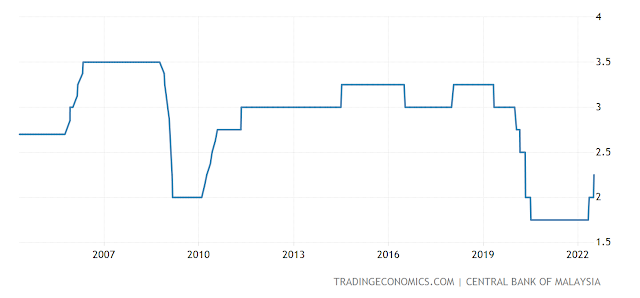

At the time of writing, the OPR was set at 2.25% (July 2022). And, in order to give you a better idea of what is the OPR level in previous years, kindly refer to the below chart.

(Throwback Article: July 2020)

💫💫💫

💫💫💫

Highlights of BNM decision to slash OPR to Record Low!!!

Follow our active updates via Facebook @FinanceMalaysia

No comments:

Post a Comment

Finance Malaysia Blog appreciates your comment. Cheers!