Do you know that our EPF account can do many things? Not only that we can do special withdrawals (limited time offer only lah, now no more...), invest in approved unit trust schemes, buy a house, reduce the housing loan balance, and now... we can buy insurance/takaful also 😃😃😃

(Before we proceed further, I would like to remind you that our EPF money is primarily meant for our retirement ya. Please bear this in mind before we make any EPF withdrawals 👀)

So, what is EPF i-Lindung platform? 🙌🙌🙌

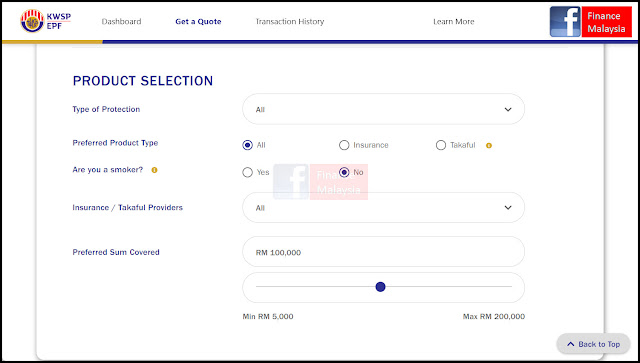

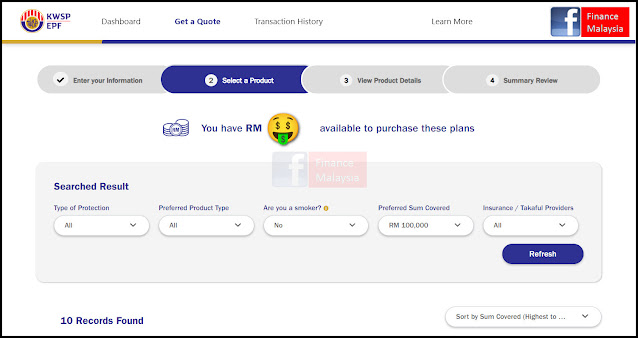

i-Lindung is a self-service platform within i-Akaun (Member) to facilitate the purchase of protection products under Members Protection Plan which allow members to withdraw funds from their Account 2 to purchase insurance and to participate in takaful products from EPF approved Insurance Companies and Takaful Operators (“ITO”).

Highlights:

- Only life and critical illness protection plans

- Only annual premium payment term

This initiative was first announced during the 2021 Budget, where EPF members will have the opportunity to sign up for insurance/ takaful protection plans offered under i-Lindung using the funds from their EPF Account. The insurance premium/takaful contribution will be automatically deducted from their account.

Members who wish to purchase insurance and participate in takaful products offered by EPF-approved insurance companies and takaful operators can do so via the i-Lindung platform within the EPF i-Akaun (Member) portal.

Login link for EPF i-Akaun: https://secure.kwsp.gov.my/member/member/login

Login link for EPF i-Akaun: https://secure.kwsp.gov.my/member/member/login

- FWD Takaful Berhad

- Prudential Assurance Malaysia Berhad

- Prudential BSN Takaful Berhad

- Etiqa Life Insurance Berhad

- Etiqa Family Takaful Berhad

A single view of the policy/certificate purchased will also be provided, allowing members to refer to it instantly and securely.

For added value, the insurance companies and takaful operators in the i-Lindung platform are able to provide additional coverage and customise the price of their products according to members’ affordability.

No medical check-up is required 💭💭💭

But, you are NOT GUARANTEED to be able to purchase the protection plan. You will be required to answer a few simple health questions (underwriting) provided by ITO, if any.

What is the Requirement?

- You have sufficient balance in your Account 2;

- Malaysian below age 55; and

- i-Akaun (Member) user.

Huh? What if I am above age 55?

Yes, you can still purchase products under i-Lindung as long as you maintain a minimum of RM100 in your EPF Account 55 and/or Account Emas and within the eligible entry age of the products offered by ITO.

Can Qualify for Tax Relief?

Yes, the premium/contribution that was deducted from your EPF Account is eligible for tax relief as per current Malaysian tax regulation and subject to the Inland Revenue Board’s approval.

Can I buy it for my spouse and children?

For now, members can only purchase for themselves.

Important Message

After getting your protection plan, remember to make a nomination for your protection plan/takaful certificate. Fyi, the insurance/takaful nomination is different from your EPF nomination. They are separately administered. Take note!

Nomination is important to safeguard the interest of your loved ones and to ensure they receive the protection as intended by you without any delay.

Without a nomination, the benefits under your policy/certificate will be paid out by ITO to your lawful executor or administrator to distribute the benefits in accordance to the applicable laws of distribution. The process may take some time.

Of course, it is important that your nominee is aware of the policy/certificate purchased by you.

You may proceed to do nomination or make a claim through the respective ITO. (No agent here 💁) For further information, you may contact the respective ITO customer service or refer to your policy/certificate documents. Alternatively, you may also refer to the My Protection Plan section under i-Lindung.

~ The End ~

Follow our active updates via Facebook @FinanceMalaysia

No comments:

Post a Comment

Finance Malaysia Blog appreciates your comment. Cheers!