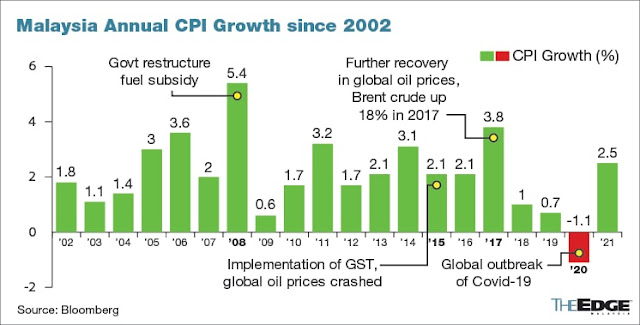

"Inflationary pressures have continued to increase, mainly due to elevated commodity prices and strong demand conditions, despite some easing in global supply chain conditions."

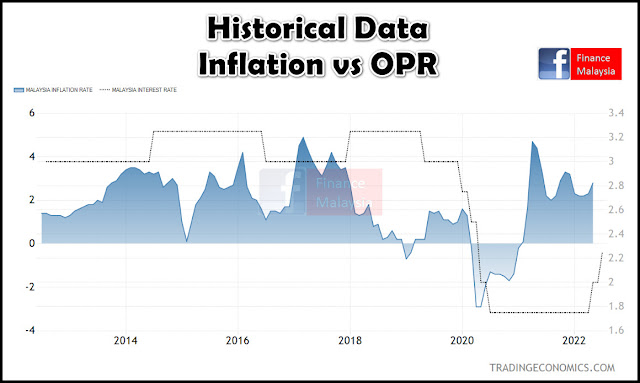

"Consequently, central banks are expected to continue adjusting their monetary policy settings, some at a faster pace, to reduce inflationary pressures," Bank Negara said in a statement after hiking the benchmark OPR for the second time this year to 2.25% (May +25bps and July +25bps).

The last back-to-back hike was May-Sept 2010.

The Inflationary Pressures... 💢💣

Malaysia’s annual inflation rate increased to 2.8% in May of 2022 from 2.3% in the previous month and beating market expectations of a 2.6% gain, reaching the highest level since last December, with food prices rising to 5.2%, the most since October 2011, amid soaring commodity prices.

In Malaysia, according to trading economics, the most important categories in the consumer price index (the official index used to determine the inflation rate) are:

- Food and non-alcoholic beverages (30% of total weight) 💥;

- Housing, water, electricity, gas and other fuels (23%);

- Transport (15%);

- Communication (6%);

- Recreation and culture (5%);

- Furnishings, household equipment and routine household maintenance (4%);

- The remaining components are restaurants and hotels and miscellaneous goods and services.

Core Inflation 💧Core inflation measures changes in the prices of all goods and services, excluding volatile items of fresh food as well as administered prices of goods by the government.

Then, how does it able to curb inflation by hiking the OPR? 👀

- When OPR increases, below scenarios will takes place:~ new loan interest rate will increase ⏫,~ installments of existing loans (variable interest rate type) will increase ⏫~ new deposit rates will increase ⏫

- People will spend less

- Businesses will buy less stock

- Effectively reducing excess demand in the market

- Over time, the prices of goods & services should eased

For existing loan borrowers with variable interest rate loan, you might feel the pinch when interest rate is going up, resulting you to pay more for the monthly loan repayments.

|

| BNM is adjusting OPR to control Inflation during good & bad times |

Although it can be burdensome when the OPR is raised, it also means the borrower will benefit when it is lowered. Do you still remember that you're actually 'enjoying from lower monthly installments' for the past two years? 😃😃😃

Tips:

Variable or Floating interest loan is normal for housing/mortgage loan. Meanwhile, our car loan is usually based on fixed or flat interest rate type, in which, the monthly installments are fixed throughout the loan tenure.

As you can see here, BNM does not directly set the prices of goods & services in an economy. Instead, BNM can influence the prices indirectly by adjusting the OPR, thus, affect the spending decision or spending behaviour of consumers.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

(Related Article)

💫💫💫

The Role of Overnight Policy Rate (OPR) in BNM's Monetary Policy

Follow our active updates via Facebook @FinanceMalaysia

No comments:

Post a Comment

Finance Malaysia Blog appreciates your comment. Cheers!