Global financial markets, including FBMKLCI, tumbled last week after Russia launched a fullscale invasion of Ukraine. Russia, which has expressed its strong disagreement over Ukraine’s intention to join the North Atlantic Treaty Organisation (NATO), has warned the former founding member of the Soviet Union to renounce this ambition and accept its sovereignty over Crimea.

The million-dollar question now is whether this will evolve into a broader military conflict between nations or can be contained via tougher sanctions or resolved through Ukraine’s submission to Russian demands.

However, the Russia-Ukraine event has resulted in declines in US Treasury yields as investors dumped risk assets in favour of safe haven assets such as US Treasuries. At one time, the yield of the 10-year UST dopped circa 12bps to below 1.90%. Meanwhile, the crisis has also pushed the Brent crude oil to cross USD100/bbl for the first time since 2014.

What does it mean to the Malaysian market?

The Ukraine crisis is a significant inflationary event. The spike in commodity prices will exacerbate global inflationary pressures, forcing central banks to raise interest rates earlier and with higher basis points.

Having said that, however, Malaysia has limited trade and business ties to Russia and Ukraine and offers a partial short-term hedge to investors given the importance of oil & gas and CPO to the domestic economy.

The likely immediate impact would be fears of supply disruptions for oil and gas-related products, which should see spikes in oil prices, generally benefiting countries like Malaysia, as we are a net exporter of oil and gas.

In addition, this is positive for Crude Palm Oil (CPO) prices and hence plantation companies in general, as the Black Sea accounts for 60% of the world’s sun oil output and 76% of exports, and any delays in shipment would further fuel the vegetable oil rally. Beyond the commodity space, we would expect the market to correct.

|

| Credit to TA Securities |

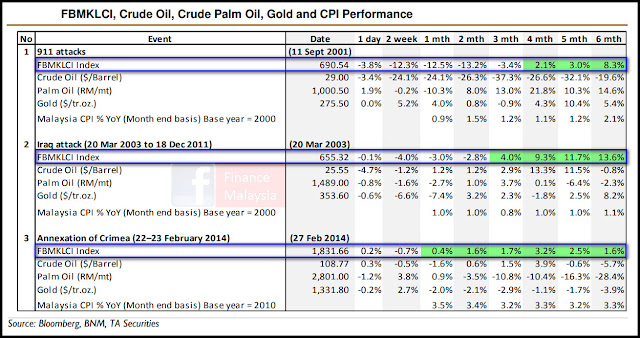

A quick check on three similar historical events, 1) the September 11 attack on the US and subsequent US invasion of Afghanistan, 2) US invasion of Iraq and 3) Russian annexation of Crimea from Ukraine, revealed that the impact on FBMKLCI was more short-term in nature.

|

| Source: Visual Capitalist |

The modern state of Ukraine was formed nearly 30 years ago after the collapse of the Soviet Union in 1991. Since then, the country has often made headlines due to political instability and the looming threat of a Russian invasion.

In the map graphic above, we examine Ukraine from a structural point of view. What’s the country’s population composition? What drives the country’s economy? And most importantly, why is the country important within a global context?

|

| (Out of topic) Ukraine has been known as a country with beautiful women 💞 |

Follow our active updates via Facebook @FinanceMalaysia

No comments:

Post a Comment

Finance Malaysia Blog appreciates your comment. Cheers!