One of the most anticipated IPO listing on Bursa Malaysia this year, Farm Fresh has been in the spotlight again lately after announcing that it has signed an underwriting agreement in conjunction with its initial public offering (IPO) on the Main Market of Bursa Malaysia Securities.

CIMB IB is the sole principal adviser and a joint global coordinator, joint bookrunner, joint managing underwriter and joint underwriter of Farm Fresh’s IPO.

Maybank IB is a joint global coordinator, joint bookrunner, joint managing underwriter and joint underwriter. Meanwhile, Affin Hwang IB, AmInvestment, Hong Leong IB and RHB IB are joint underwriters of the IPO.

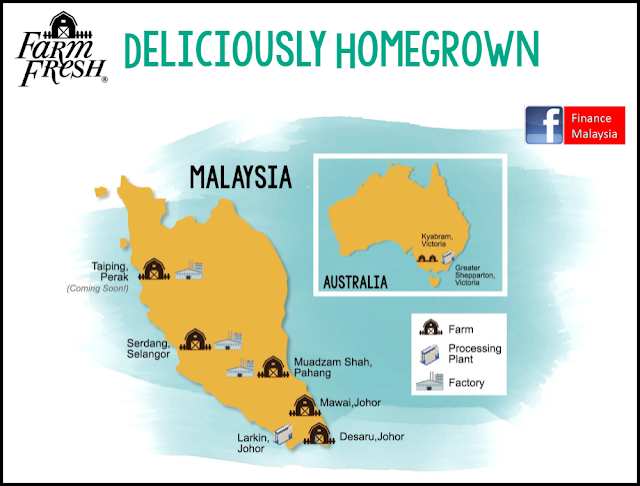

The principal activity of Farm Fresh is rearing dairy cows and the sale of dairy cows’ milk whilst, together with its subsidiaries, they form a fast-growing vertically integrated dairy group engaged in the business of farming, manufacturing and distribution of various dairy products and plant-based products. Currently, the Group operates 5 dairy farms in Malaysia and 1 dairy farm in Australia.

The Group has a diverse product portfolio that consists primarily of chilled RTD milk products, UHT/ambient RTD products, plant-based products, yogurt products and fruit jam and sauces.

The SIX Competitive Strengths of Farm Fresh Bhd:

- One of the largest and fastest-growing players in the attractive Malaysian dairy industry

- An attractive and diversified portfolio of proprietary brands built on a fresh milk proposition and supported by a culture of innovation

- Vertically integrated “grass-to-glass” model providing operational and financial benefits

- Strong competitive advantage through gene bank ownership and notable farm management and animal husbandry practices

- Extensive market penetration through a multi-channel distribution network

- Strong and experienced management team with significant emphasis on ESG initiatives

What's its Market Share if compared to Nestle & Dutch Lady?

Currently, Farm Fresh is among the top three players in both RTD milk and yogurt categories. Its market share and ranking have increased over the years, and continued to increase compared to other players even in the first half of 2021, when it still recorded sales growth despite the market recording a slight decline compared to the same period in 2020.

Farm Fresh is estimated to be the second-largest player in the RTD milk category and the third-largest player in the yogurt category in Malaysia in the first half of 2021. Within the same period, Farm Fresh is also estimated to be the market leader in Malaysia in the chilled RTD milk segment.

What are the Future Plans and Strategies?

- Expanding the upstream capacity while improving operational efficiency and deepening the distribution network

- Continue to develop and grow the product portfolio by leveraging on the current market recognition of the brands

- Regional expansion to Southeast Asia and the Asia Pacific regions

What is the Dividend Policy of the company?

Fyi, the company has not declared or paid dividends to its shareholders for the past three financial years. Yet, the company targeted a payout ratio of approximately 25% of the net profit of each fiscal year on a consolidated basis.

|

| Deliciously homegrown, same as us at Finance Malaysia 😜 |

The IPO consists of the Institutional Offering and the Retail Offering, totaling up to 743,181,900 IPO Shares, representing up to about 40% of the enlarged issued share capital.

However, only 3% will be allocated to Retail Offering as below:

- 1% allocation to the Eligible Persons

- 2% allocation via balloting to the Malaysian Public 😪 (Sienzzz liao lol...)

What is the IPO price?

In a press release on 28 Feb 2022, Farm Fresh noted that it will raise approximately RM1 billion, in an offer for sale of up to 520.2 million of its share and a public issue of 223 million new shares, based on an initial offering price of RM1.35 per share.

Meaning, this will be the Malaysia’s largest IPO since June 2021. (The previous holder is CTOS which has raised RM1.2 billion)

The Valuation is Expensive or Cheap?

Based on the IPO price of RM1.35, this values the company at approximately 69x FY2021 profit of RM36.2 million and 36x adjusted profit of RM69 million after taking into consideration factors that include one off tax liability expenses, according to the press statement.

Wow. Not cheap oh. But, Farm Fresh noted that the IPO has secured support from a record number of 30 cornerstone investors, the most seen in a Malaysian IPO to date. 😍😍😍 They are:

Wow. Not cheap oh. But, Farm Fresh noted that the IPO has secured support from a record number of 30 cornerstone investors, the most seen in a Malaysian IPO to date. 😍😍😍 They are:

- Abrdn

- Affin Hwang Asset Management

- AIA

- Alcea Rosea (Creador)

- Barings Singapore

- Eastsprings Investments

- Employees Provident Fund

- Fortress Capital Asset Management

- Franklin Templeton Asset Management (Malaysia)

- Great Eastern Life Assurance (Malaysia)

- Hong Leong Asset Management

- Hong Leong Assurance

- JP Morgan Asset Management (Singapore)

- KAF Investment Funds

- Kenanga Investors

- Kumpulan Wang Persaraan (Diperbadankan)

- Lembaga Tabung Haji

- Manulife Investment Management

- Maybank Asset Management

- Merit Glory (Ikhlas Capital)

- New Silk Road Investment

- OAKS Emerging Umbrella Fund

- Permodalan Nasional Bhd

- Principal Asset Management

- Social Security Organisation

- UBS Asset Management (Singapore)

- UOB Asset Management (Malaysia)

- Urusharta Jamaah

- Value Partners Hong Kong

- Zurich Life Insurance Malaysia

Applications for the public issue portion are open from Monday (Feb 28) and will close at 5pm on March 8. The group is scheduled to be listed on the main market of Bursa Malaysia on March 22.

Follow our active updates via Facebook @FinanceMalaysia

No comments:

Post a Comment

Finance Malaysia Blog appreciates your comment. Cheers!