Among all the utility companies in Malaysia, many people would only remember the giant Tenaga Nasional Bhd. Other than Tenaga, there are plenty of good local utility companies and one of them is Ranhill Utilities Berhad (Ranhill), which is a conglomerate with an interest in the environment and power sectors.

A little bit of background

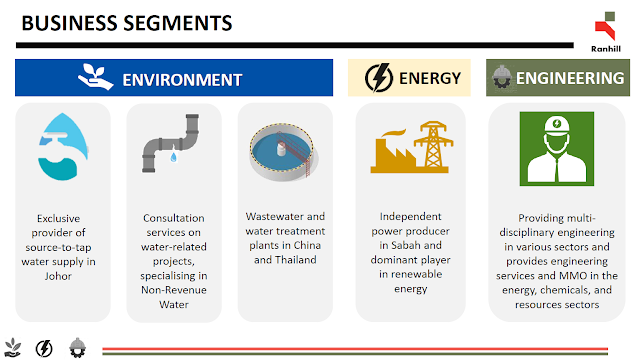

In the environment sector, Ranhill provides water supply services, operates water and wastewater treatment plants, and provides technical services in the management and optimisation of water utility assets. In the power sector, Ranhill develops, owns and operates 2 power plants in Sabah.

Environment Division provides water supply in the Johor State, and operates water, wastewater and reclaimed water treatment plants in Johor, Thailand and China. The Division also provides technical services in the management and optimization of water utility assets as well as Non-Revenue Water Management.

Energy Division, which provides a solid recurring revenue business, consists of the development, ownership, operation and maintenance of 2 Combined Cycle Gas Turbine power plants, which have a total electricity production capacity of 380 Megawatts.

New Growth Strategies...

- Ranhill Bersekutu Sdn Bhd (RBSB)RBSB is one of the leading engineering firms established in providing multidisciplinary engineering in various industries such as, comprehensive engineering solutions, Project management and EPCM, Building Information Modelling (BIM) & Geographical Information System (GIS).Since RBSB is 30% in water treatment and 70% in EPCC business, this allows them to have exposure to infrastructure projects such as highways and railroads. This could open up future projects bidding in East Malaysia or Indonesia.

- Ranhill Worley Sdn Bhd (RWSB)RWSB was established in 1996 as a joint venture between Ranhill Berhad (51%) and Worley Australia (49%). Then, who is Worley?Many people may not know that Worley is Australia’s largest exporter of knowledge-based services and second-largest Engineering Chemical and Resources (ECR) in the world. The company is a leading global provider of professional project and asset services in the energy, chemicals, and resources sectors.So, Ranhill could benefit from technology transfer from Worley. Meantime, Worley is currently involved in many other RE segments i.e., biomass and windfarm. Would it be another possible route for Ranhill to has exposure in these RE segments?

The ESG theme

Ranhill had recently made its foray into the RE sector when it was awarded a 50MW package under the recent LSS4 bidding and subsequently signed the Power Purchase Agreement with TNB for a period of 21 years. It won’t just stop there, and Ranhill aims to participate in the upcoming LSS5 bidding exercise. Wow. That’s great! 😍

On a brighter and wider aspect, Ranhill is aiming for long-term sustainability via Circular Economy Model with Zero Discharge by:

- Producing zero waste and reusing or recycling resources used in a complete cycle

- Comply with laws and requirements in the countries and able to treat the wastewater lower than standard compliance

- Growing Renewable Energy with the deployment of Solar Power PV in treatment plants

In conclusion with figures…

MIDF Research in a recent report stated that the utility group expects that in the next three years, the engineering division will contribute 20% to its revenue, with the remaining 65% and 15% coming from the environment and power divisions.

To sum it up, among the potential catalysts for Ranhill are:

- The business model is somewhat close to ESG already since their business is naturally in reducing water wastage, and now Ranhill is moving towards to include solar power business.

- A potential candidate to be included in the FTSE4GOOD index, riding on the global ESG theme of investing.

- By having a strong footing in the Sabah energy sector currently, Ranhill could benefit from the potential surging energy demand from Indonesia. Don’t forget that Indonesia is going to relocate its capital to the island of Borneo in the first half of 2024.

Follow our active updates via Facebook @FinanceMalaysia

No comments:

Post a Comment

Finance Malaysia Blog appreciates your comment. Cheers!