Being one of the 5 measures (click here to read) which were highlighted by BNM to safeguard online banking users, financial institutions were advised to move away from using SMS TAC (or SMS OTP) to a more secure and better method.

The largest bank in Malaysia, Maybank, said that it will fully migrate to a more secure authentication method via Secure2u by June 2023, from SMS one-time password (OTP), to heighten online banking security.

Obviously, this is in line with BNM’s steer for banks to migrate from SMS OTP to more secure authentication for online banking transactions, Maybank said in a statement.

Wait.

Then, why SecureTAC is better?

Meaning, using SecureTAC reduces your exposure to SMS TAC fraud.

- No more waiting for SMS

- And, because of that, it works while you're in overseas too!

- SecureTAC protects your transactions with enhanced encryption so that you can approve your web/app transaction right from your banking app quickly and safely

- You need to register/activate your SecureTAC feature first before using it, thus, making it safer

- The bank no need to pay the telco on the SMS services (this is what I think lah...😙)

Fyi, whenever a message was being sent via an SMS, there is the possibility of your online banking details being compromised or used by any third party.

"To further strengthen your online banking security, starting October 2022, the Secure2u feature on the MAE app will be enhanced with a 12-hour activation period when you enable Secure2u on a different device. This helps to prevent unauthorised Secure2u approvals."

Secure Verification vs Secure TAC

Bonus for you lah. Actually, there is a slight difference between the two methods to approve your transactions. Both are also secured, but with different methods only.

Bonus for you lah. Actually, there is a slight difference between the two methods to approve your transactions. Both are also secured, but with different methods only.

- Secure Verification

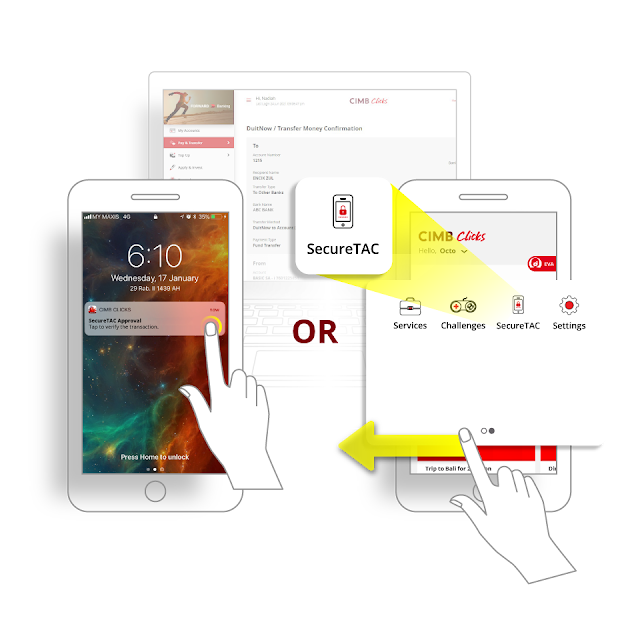

Once you've requested for a Secure Verification, you will receive a push notification alert on your smartphone (this is the device you registered for Secure2u). Tap on the push notification to view your Secure Verification, then ‘Approve’ or ‘Reject’ the transaction within the time limit. - Secure TAC

You can get the 6-digit Secure TAC from your banking App by tapping on ‘Secure2u’ on the app menu. For Maybank, on the MAE app, tap ‘More’ > ‘Secure2u’ to retrieve it. Enter the Secure TAC to approve your transaction. This 6-digit number is auto-generated every 30 seconds, so make sure the number is still valid when you enter it.

Follow our active FB page via

Follow our Crowdfunding FB page via

Follow our e-wallet FB page via

No comments:

Post a Comment

Finance Malaysia Blog appreciates your comment. Cheers!