As part of continuous efforts by Bank Negara Malaysia to enhance competitiveness in the economy and to develop the domestic financial markets, Bank Negara Malaysia wishes to announce the following liberalisation measures, with effect from 31 January 2012:

- To further spur the domestic foreign exchange market through greater product innovation, licensed onshore banks are permitted to trade foreign currency against another foreign currency with a resident.

- To further deepen the domestic interest rate derivatives market, a licensed onshore bank is allowed to offer ringgit-denominated interest rate derivatives to a non-bank non-resident.

- Towards enhancing the asset liability management of residents, flexibility is permitted for a resident to convert their existing ringgit or foreign currency debt obligation into a debt obligation of another foreign currency.

The above measures which are in line with the broad thrust of the Financial Sector Blueprint will contribute towards increasing the liquidity, depth and participation of wider range of players in the domestic financial markets.

Frequently Asked Questions:

- Can a resident buy and sell foreign currency against another foreign currency for any purpose?

- Yes. With this liberalisation, a resident is allowed to buy and sell foreign currency against another foreign currency for any purpose including for trading. However, such transactions shall only be undertaken with a licensed onshore bank.

- Does the liberalisation include trading of foreign currency against ringgit?

- No. The liberalisation is only for transactions involving foreign currency against another foreign currency for any purpose.

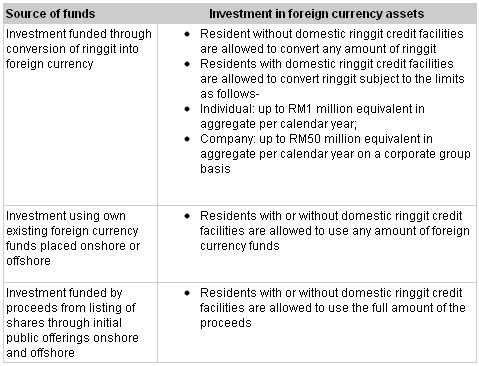

- What are the prevailing rules on investment in foreign currency assets?

- Who are the licensed onshore banks?

- licensed commercial banks in Malaysia;

- licensed Islamic banks in Malaysia; and

- licensed investment banks in Malaysia.

- What are the prevailing rules on foreign currency credit facilities obtained by a resident?

For further information and enquiries on the measures, members of the public may contact Bank Negara Malaysia via Toll free line : 1 300 88 5465 (BNMTELELINK)

Source: BNM website

No comments:

Post a Comment

Finance Malaysia Blog appreciates your comment. Cheers!